Do legal worries keep you up at night now that you finished your Writer’s Business Plan and are treating your writing as a business?

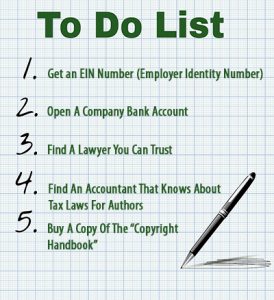

Starting a new writing business is scary, but you will get a full night’s sleep if you do these 5 tasks to protect your company:

- Get An EIN (Employee Identification Number) – The EIN number is free and assigned by the IRS (bit.ly/29eSpaw) Even a sole proprietor can get an EIN number. You can use this number instead of your social security number when dealing with online retailers.

- Open A Company Bank Account – you want somewhere for online retailers to send your money! Banks will ask for either your social security number or EIN number. Since you don’t want to give out your social security number to online retailers, get an EIN number and give this to your bank when opening your new company bank account.

- Find A lawyer You Can Trust – ask for references. Your local writers group members can give you some suggestions. You want a lawyer who understands laws related to authors and creative arts contracts.

- Find An Accountant Knows Tax Laws For Writers – You don’t want to get into trouble with the IRS but you do want to take advantage of the legal deductions you can take as a writer. Find an accountant that works with other artists.

- Buy A Copy Of The Copyright Handbook by Stephen Fishman. Writers need to understand copyright. The way to make your business a success is to avoid law suits and to know what to do if someone brings a suit against you. Don’t break copyright laws and know your options if someone violates your copyright.

Leave a Reply

We respect your privacy. Your email address will not be shared or sold.